Global Economic and Financial Analysis: Trade Wars, Market Volatility, and Investment Trends

Introduction

The global economic landscape is witnessing significant turbulence as political, financial, and technological factors shape market dynamics. From trade wars between Canada and the United States to rising market volatility, shifts in cryptocurrency regulation, and corporate financial performances, investors and policymakers are navigating a period of uncertainty. This article delves into the recent developments that are shaping the global economy, financial markets, and investment opportunities.

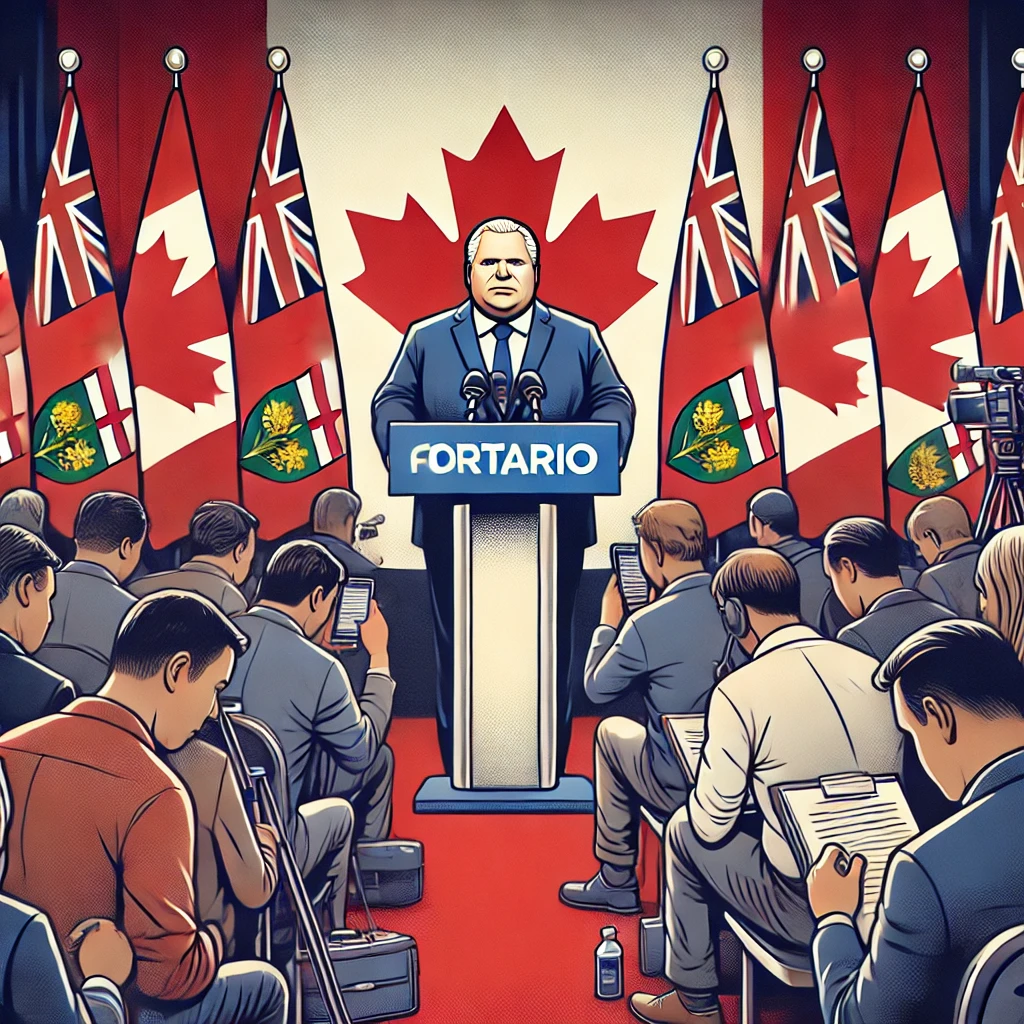

Ontario Cancels Starlink Contract Amid Trade War With the U.S.

Background of the Trade Dispute

In a move that signals escalating tensions between Canada and the U.S., Ontario Premier Doug Ford announced the cancellation of a $100-million contract with Elon Musk’s Starlink. This decision comes in retaliation against President Donald Trump’s new tariffs on Canadian goods, a move that has reignited trade hostilities between the neighboring nations.

The original contract, signed in November, aimed to expand high-speed internet access to rural and northern Ontario, where connectivity remains a significant challenge. However, with rising tensions, Ford justified the move as necessary to protect the provincial economy from external pressures.

Economic Ramifications of the Contract Cancellation

The abrupt contract termination has raised concerns among industry experts about the long-term effects on Ontario’s technological development. Rural areas are particularly vulnerable to setbacks in internet accessibility, which could slow down business operations and limit educational opportunities. Furthermore, businesses that rely on satellite internet services are now left seeking alternative providers, potentially at higher costs.

Broader Trade Implications

With the removal of American liquor brands from Ontario’s government store shelves and restrictions on U.S. companies bidding for contracts, Ford’s administration is doubling down on its retaliatory measures. Given that Ontario’s economy is deeply intertwined with U.S. trade, these moves could have far-reaching consequences, prompting a reevaluation of existing economic partnerships.

Long-Term Political and Economic Consequences

The cancellation of major contracts with American companies raises questions about the stability of trade agreements between the two countries. This could lead to a domino effect, where other provinces or industries decide to follow suit, thereby intensifying trade tensions. Some experts argue that these economic sanctions may lead to increased domestic investment, while others caution that it could limit foreign investment opportunities in Canada.

Read more: Ontario Cancels Starlink Contract

Wall Street Volatility: The Return of Market Uncertainty

VIX Spikes Amid Trade War and AI Disruptions

The Cboe Volatility Index (VIX), also known as Wall Street’s “fear gauge,” surged by 23%, reaching 20.26. Historically, a VIX reading above 20 is considered a sign of high market volatility, while a reading above 30 signals extreme panic. This spike suggests investors are bracing for increased market instability due to geopolitical and economic tensions.

Impact of AI on Market Stability

Adding to the uncertainty, China-based AI firm DeepSeek has introduced low-cost AI models that have disrupted tech stocks. With AI advancements becoming a game-changer in multiple sectors, traditional tech firms are facing competitive pressures, leading to sharp stock price fluctuations.

Investor Strategies Amid Volatility

Institutional investors are responding to the uncertainty by shifting capital into safer assets such as gold, government bonds, and dividend-yielding stocks. Meanwhile, hedge funds are taking advantage of price swings through algorithmic trading strategies designed to capitalize on high volatility.

Global Repercussions of Market Volatility

The increased volatility is also affecting global markets, as emerging economies that rely on stable trade with the U.S. are seeing fluctuating investment patterns. As hedge funds capitalize on instability, individual investors are advised to remain cautious and diversify their portfolios.

Read more: Wall Street Volatility

Grayscale Pushes for First-Ever XRP ETF

Grayscale’s Crypto Expansion Strategy

Grayscale Investments, a leading cryptocurrency asset manager, has filed for SEC approval to convert its $16 million XRP trust into an exchange-traded fund (ETF). If approved, this would mark the first-ever regulated XRP ETF in U.S. markets, providing mainstream investors an easier way to gain exposure to the third-largest cryptocurrency.

Regulatory Hurdles and Market Expectations

With SEC Chair Gary Gensler stepping down, regulatory sentiment is shifting towards more crypto-friendly policies. The potential approval of the XRP ETF would pave the way for other altcoin-based ETFs, expanding crypto’s role in institutional portfolios.

Future of Crypto ETFs

The approval of an XRP ETF could lead to increased liquidity in the cryptocurrency market and attract more institutional investment. However, it also poses regulatory risks, particularly regarding securities classification and investor protection.

Comparison with Other Crypto ETFs

Unlike Bitcoin and Ethereum ETFs, XRP faces additional scrutiny due to its long-standing legal battles with regulators. If approved, this ETF could serve as a landmark decision that influences future altcoin regulations.

Read more: Grayscale’s XRP ETF Filing

JPMorgan Chase & Co.: A Safe Haven Amid Market Uncertainty?

Stock Performance and Institutional Confidence

JPMorgan Chase (JPM) has continued to attract institutional investors, with firms such as VCI Wealth Management increasing their holdings. The stock currently trades at $267.14, approaching its all-time high of $270.82.

Why Investors Favor JPMorgan During Uncertain Times

JPMorgan’s strong earnings report and strategic positioning in global financial markets make it an appealing choice for long-term investors. The company’s well-diversified revenue streams—ranging from investment banking to consumer financial services—provide stability even in volatile conditions.

Analyst Ratings and Market Outlook

- Piper Sandler: Upgraded JPM stock price target to $275.

- Wolfe Research: Rated as “outperform,” citing strong financial fundamentals.

- Dividend Strength: The firm maintains a 1.87% dividend yield, reinforcing investor confidence.

JPMorgan’s Influence on Global Banking Stability

As one of the largest financial institutions, JPMorgan’s strategies and risk management decisions have ripple effects across the banking sector. Their focus on long-term sustainability rather than short-term gains positions them as a cornerstone in economic stability.

Read more: JPMorgan Chase & Co. Market Overview

Conclusion: Navigating an Uncertain Future

From geopolitical trade wars to rising volatility in financial markets, investors must navigate a rapidly shifting economic landscape. The Ontario trade dispute with the U.S., Wall Street’s volatility, and regulatory shifts in crypto illustrate how interconnected global markets have become.

Key Takeaways:

- Diversification is crucial amid rising market uncertainty.

- Technology and AI sectors remain high-growth areas despite disruptions.

- Stable financial institutions like JPMorgan continue to offer security in turbulent markets.

- Crypto adoption is accelerating, but investors must assess risks associated with altcoins.

As global markets adapt to changing policies, trade disputes, and financial trends, staying informed will be essential to making sound investment decisions.

Stay informed: Global Economic Trends